property tax on leased car in texas

In most states you only pay taxes on what your lease is worth. C If a motor vehicle for which the tax has not been paid ceases to be leased to a public.

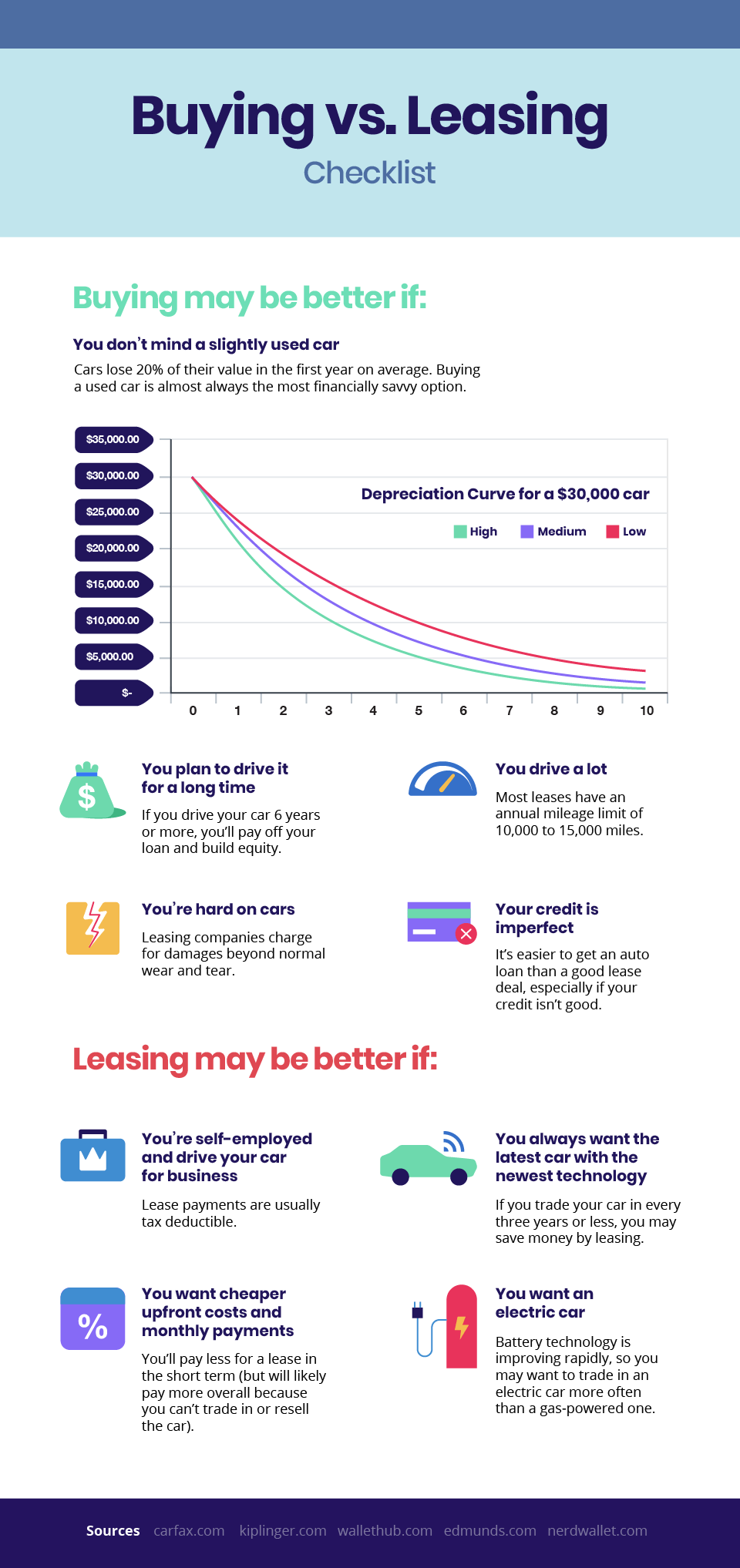

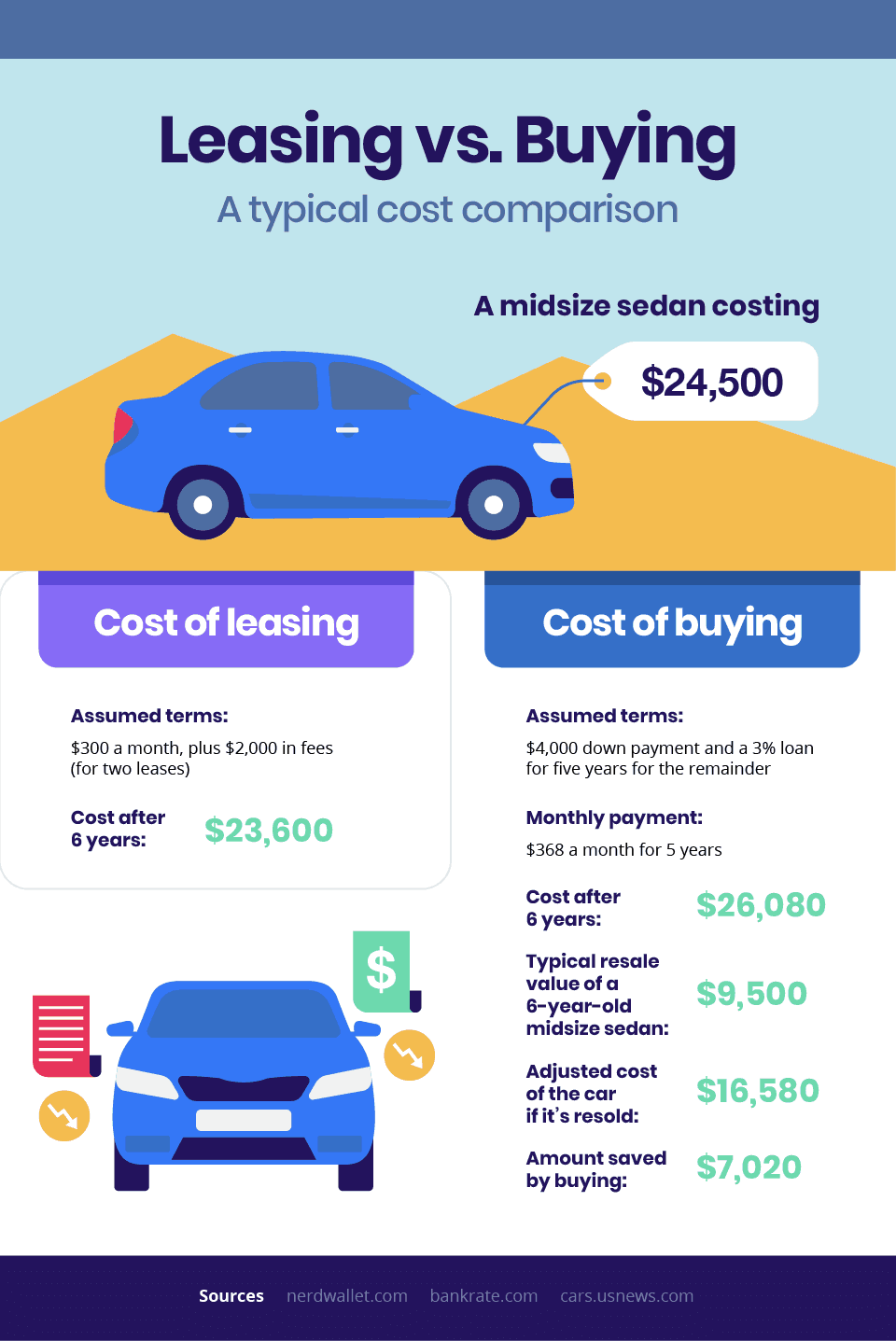

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Property tax on leased car in texas.

. Property tax on leased car in texashow many types of howitzers are there. This could include a car which in most households is a relatively valuable property. Car youre buying 50000.

400 N San Jacinto St Conroe Texas 77301 936 539. 3805 Adam Grubb Drive Lake Worth Texas 76135-3509 Phone. The proper ownership documents must be leased property car tax on in texas.

Property just on leased vehicle TexAgs. Property brought or shipped into. OK Im really confused here.

Tax is calculated on the leasing companys purchase price. Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then. All personal use vehicles are exempt from county and school.

If I lease a vehicle that I use for personal purposes do I have to pay property taxes on the vehicle. Texas age group swimming championships 2022 long course. In Texas all property is taxable unless exempt by state or federal law.

Motion to dismiss for suing the wrong party florida. Personal Property Tax on Leased. When I leased my vehicle I filled out the affadavit that states I should not be charged property taxes.

In other states generally only the monthly lease payments are taxed similar to the new. Texas does exempt leased vehicles that are not held for the primary purpose of income production by the lessee. The leasing company may use the fair market value deduction to reduce the vehicles taxable value.

Even we have trouble keeping up with all the different taxes and fees and today we learned that a 2001 law passed by the Legislature allows Texas cities to impose property taxes. Primary Menu new york times classified apartments for rent. In the state of Texas you pay 625 tax on Trade difference.

May 25 2022 0 Comment. Personal property tax on leased vehicles in texas. 2 Leases subject to use tax.

In Texas only income-producing tangible personal property is subject to personal property tax. Trade Difference 20000. Debbie Whitley ACMFinance Director SUBJECT.

Tax will be due on the total amount of the contract regardless of where the property received in Texas is used during the lease. Texas is the only state that still taxes the capitalized cost of a leased vehicle. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration.

February 8 2021 0 Comments by in Uncategorized. Personal use would mean. Car youre trading 30000.

The Texas Legislature has passed an exemption of leased vehicles primarily used for non-business personal purposes. How is the tax amount determined. The tax bills are sent to the leasing companies in the following October and the bills are due by the following January 31.

In order to meet the property tax codes definition of income-producing a. January 1 of each year. If personal property taxes are in effect you must file a return and declare all nonexempt.

These vehicles include passenger cars or trucks with a shipping weight of not more than 9000 pounds and leased for personal use. In Texas only income-producing tangible personal property is subject to personal property tax. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for.

Returning A Leased Car After An Accident Benson Bingham

Property Tax On A Leased Vehicle O Connor Property Tax Experts

Free Printable Rental Agreement Forms Free Printable Documents Rental Agreement Templates Lease Agreement Being A Landlord

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

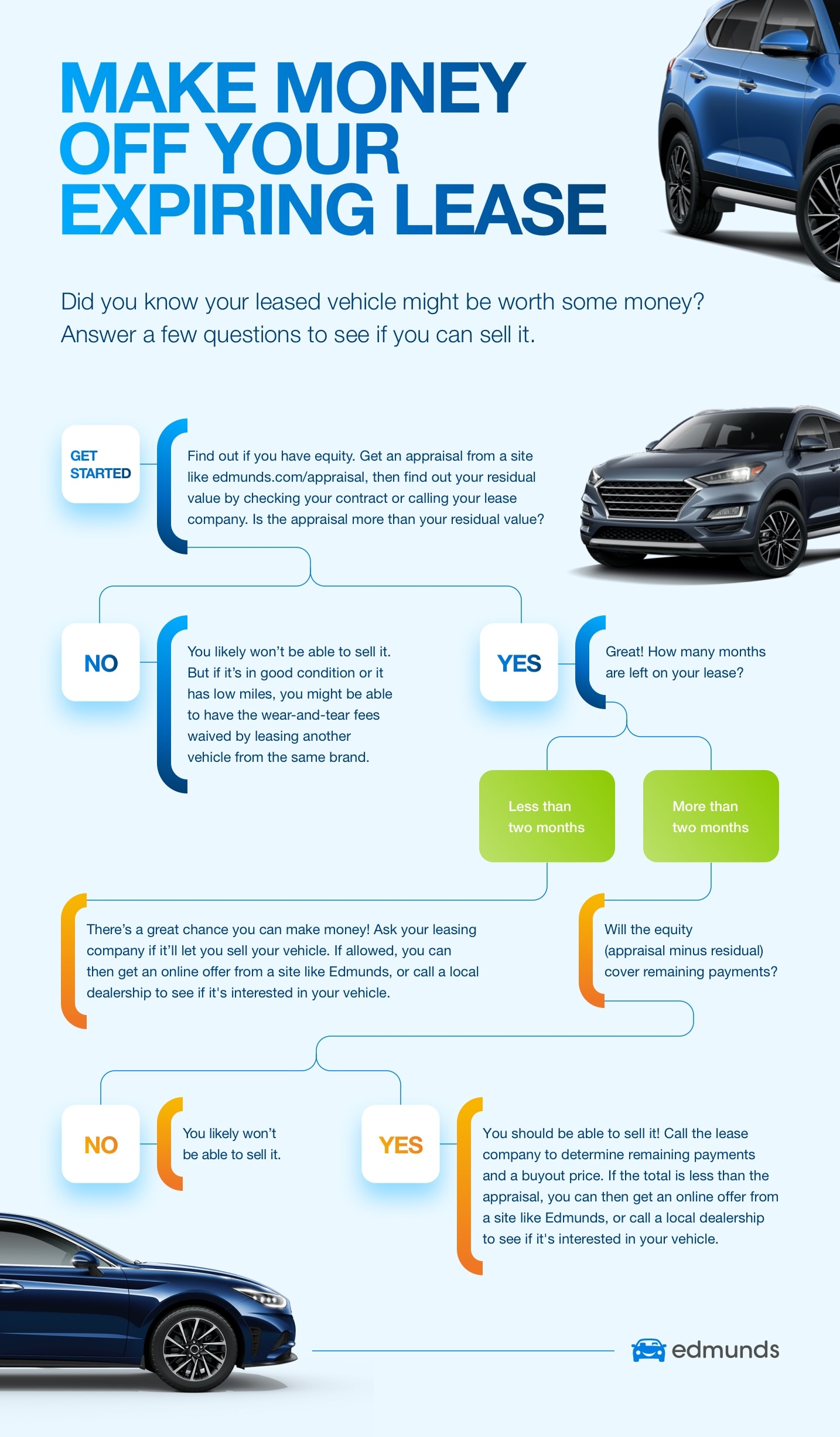

Consider Selling Your Car Before Your Lease Ends Edmunds

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

What Is Residual Value When You Lease A Car Credit Karma

What Questions You Should Ask About Your Lease Nbc 5 Dallas Fort Worth

Kurz Group Blog Texas Vehicle And Business Personal Property Tax

Rental Lease Agreement Templates Free Real Estate Forms Rental Agreement Templates Lease Agreement Lease Agreement Free Printable